No Brainer.

It’s no surprise that the stormy season has graced us with its presence the past couple of weeks yet again. With all its gray skies and rainy days that never seem to end. Rain has already drenched the Texas area triggering flash flooding causing damages to homes, cars, and businesses. Unless you’re the master of flood preparation, you might consider flood insurance.

It’s not too late to protect your home and your family with flood insurance. Not knowing what kind of damage these hazardous rainfalls could potentially create is a scary thing. Now is the time to take the necessary precautions in order to protect your family and your assets from these rising waters before it’s too late.

3 Steps to Becoming Content with the Floods

Did you know that business and homeowners insurance does not cover flood damage? Most people are unaware that you must obtain a flood insurance policy separately from your standard homeowners or business insurance policy.

Step 1: Quickly Assess Your Risk

The majority of business flood insurance comes from low to moderate risk areas. Whether you live in a low-risk flood zone as determined by FEMA and the National Flood Insurance Program or in a high-risk area, we highly recommend coverage.

Sub-heading

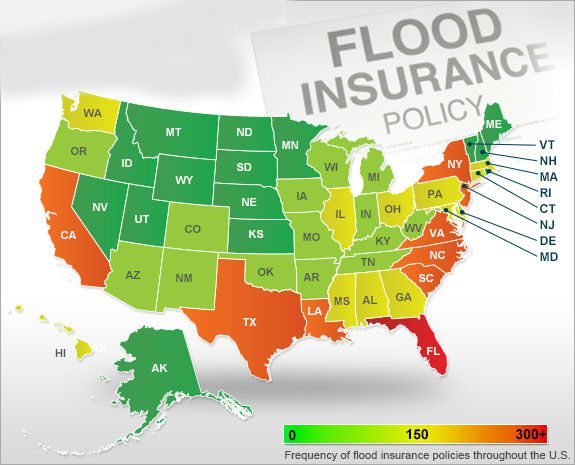

Dexter & Company can assess the potential damage that may arise during these rainy seasons on your property. We do that by effectively managing your risks and providing the best coverage available. As you can see from the map below, major flood insurance areas are in Texas, California, Louisiana, Florida, South Carolina, North Carolina, Virginia and New York.

Step 2: Prepare

You never know when a flood could hit, so it’s always best to prepare yourself and your home. Here are a few tips to prepare for a flood:

Step 3: Select Coverage

Now, before you start panicking, there is an excellent solution to this potentially devastating problem. By connecting you with one of many available flood insurance programs, we can help relieve the worry and frustration that these severe storms are causing

These programs compete directly with the FEMA and National Flood Insurance Program to offer better personal and commercial coverage options with lower rates and fees. We dedicate ourselves to providing you with 24/7 support for claims with some of the most reputable and exclusive carriers in the marketplace.

Sub-heading

Maybe you live in San Diego and can accurately predict the weather every day. However, the weather elsewhere is not as consistent as in southern California. Even though you’re most likely accustomed to the unpredictable Texas weather, your property may not be.

Next Steps

Dexter & Company has been helping commercial and residential property owners cover risk and exposures for over 140 years. We keep ourselves knowledgeable with the most up-to-date information in the insurance industry so that we may better serve our clients during these unpredictable times.

Please contact us today so we can help you mitigate an unnecessary risk by assisting you with your flood insurance policy.